Going solar can offset your home’s environmental footprint. But which option lets you keep more cash in your pocket — buying or leasing solar panels?

The possibility of producing my own electricity has always inspired me to learn more in that direction.

As an electrical engineer and green citizen, I decided that solar is the way to go and got down to my homework.

I hired a building expert to inspect my roof for an additional load of solar panels and asked what incentives and rebates the government offered. I even calculated that the specific photovoltaic power output (PVOUT) for my home’s location is around 6 kWh/day.

Not too shabby!

And then came the big decision: Should I go with buying or leasing solar panels?

Let me tell you, the choice was tough, as I saw real benefits on both sides.

In the end, I think I’ve done the right thing.

If you’re facing the same solar leasing vs. purchase dilemma, I might have the solution.

Installing Solar Panels: Exploring All the Options

Should I Buy…

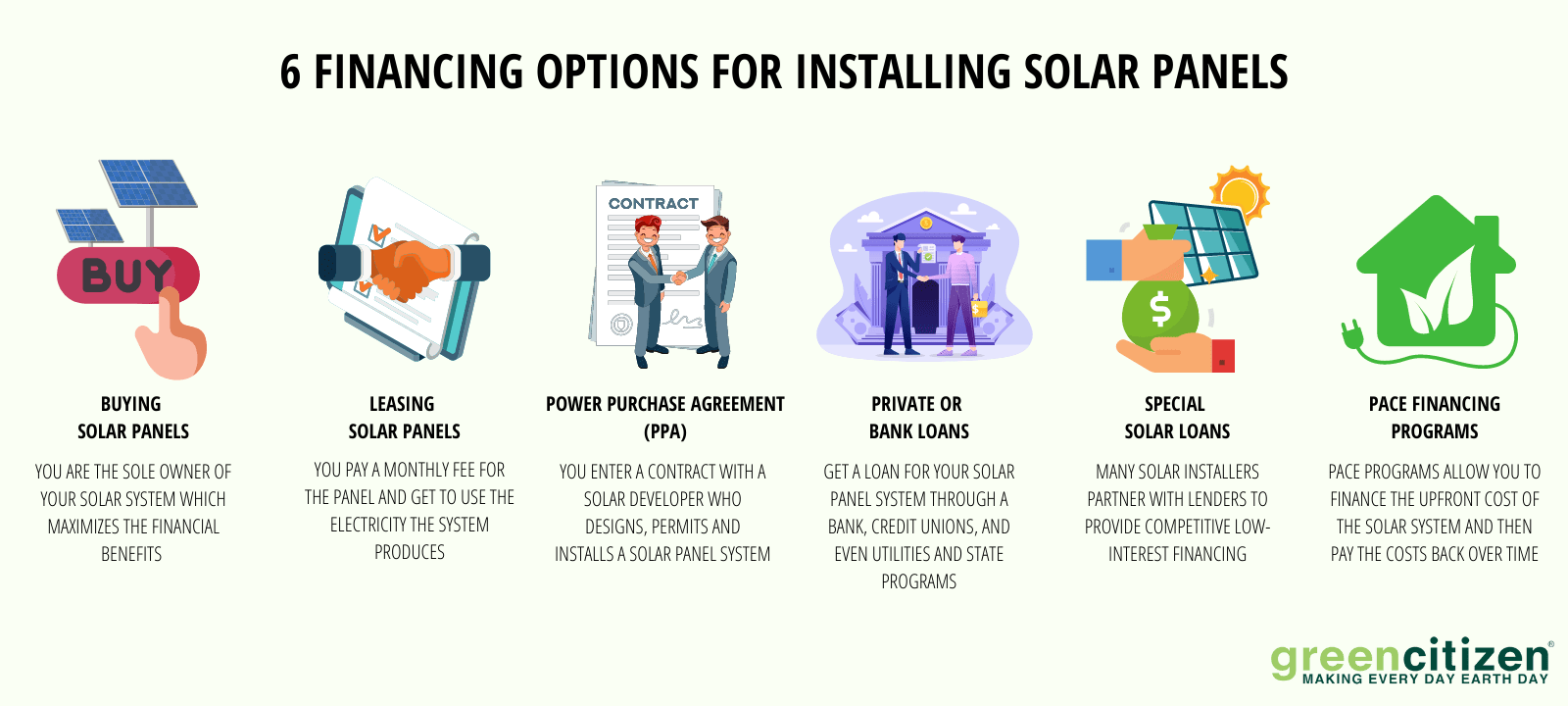

Buying solar panels is the simplest and the cleanest route. You are the sole owner of your solar system which maximizes the financial benefits of your installation.

You don’t have to make monthly payments to anyone, so your solar system is working for you from day one.

Besides, your home’s real property value increases the moment you install the panels you own. According to the National Bureau of Economic Research, solar panels can add a $20,000 value premium to the sales price of a mid-$500,000 home.

Finally, as the owner, you can take economic advantages such as reduced state taxes, government rebates, and incentives that can amount to almost 30% of the upfront cost.

Or Should I Lease?

In solar leasing, you pay a monthly fee for the panel and get to use the electricity the system produces. An important difference is that in this case, you do not own the panels.

There are many pros to leasing. Your upfront costs are very low, in some cases even zero. In a lease agreement, the maintenance and liability rest on the solar company, so you don’t have to bother with servicing.

On the other hand, the solar company also reaps all the benefits like tax incentives and government rebates.

Also, your monthly payments are likely to increase to catch up with current market prices, which cuts your savings even more.

Is PPA the Same as Leasing?

Solar power purchase agreement (PPA) is similar to solar leasing in the sense that you have zero upfront costs and do not own the solar system.

But this is where the similarity ends.

In a PPA, you enter a contract with a solar developer who designs, permits and installs a solar panel system on your roof.

So you pay every kWh of solar used to the developer, which is less than you would pay to the utility.

In areas where PPA is supported, the utility pays you the excess solar energy that you don’t use.

In return, the utility provides your home with electricity when solar panel output is low.

At the end of the contract, which lasts from 5 to 25 years, you can choose to renew the contract, have the panels removed, or purchase the solar panels at their real market value.

The last option is probably the worst for you. I’ll explain this in a minute.

Private or Bank Loans

If you’ve ever applied for a car loan, you know what I’m talking about. Instead of paying one large sum, you pay smaller monthly installments over an agreed period.

You can get a loan for your solar panel system through a bank, credit unions, and even utilities and state programs.

Ask if your utility offers on-bill financing, so you can repay the loan through your monthly electricity bill.

If you decide to sell a house with panels installed, the loan remains tied to you. You can either try to pay the remainder at once or try to include the remaining balance in the price of the home.

What About Solar Loans?

The price of solar technology is dropping with governments offering financial incentives and tax credits. Even so, a typical rooftop solar system still costs between $15,000 and $30,000.

If you don’t have that kind of money right away and don’t want to wait to save up, you could try to qualify for a solar loan.

There are secured and unsecured solar loans. With an unsecured loan, you don’t have to put your house as collateral, but the interest isn't tax-deductible.

While many solar installers partner with lenders to provide competitive low-interest financing but make sure to read the whole terms & conditions.

In my experience, I could always find better rates directly with banks and credit unions.

How Does PACE Financing Work?

The Property Assessed Clean Energy (PACE) programs allow you to finance the upfront cost of the solar system and then pay the costs back over time.

What makes PACE assessments different from solar loans is that they are attached to the property, and not to you.

The property owner repays the solar panel costs over a set period of time as an addition to the property tax bills.

How Many Panels Do You Need and How Much Do They Cost?

The average American home needs about 20 solar panels. This comes from the average electricity usage of 877 kilowatt-hours (kWh) per month.

Installing that number of solar panels costs between $13,000 and $16,000 after the federal solar tax credit.

But what if your home’s energy needs more or less energy than the U.S. average?

Not to mention that the number of panels you need depends on several other factors, such as the location of your home and the type of solar panels you’re looking to get.

So what’s the real number?

First, you need to tell me:

Your Energy Usage

Check out the last power bill. The total amount of electricity used will be shown at the bottom of the bill in kilowatt-hours. You’ll get the most accurate estimate if you compare several bills from different seasons.

It would be great if you could dig up your monthly electric bills for the past year, add them up and divide them by 12. And there’s your average energy usage.

If your home uses 12,000 kWh per year and you want to go 100% solar, your panels must be able to deliver that.

The Amount of Sunlight You Get

The rule of thumb is that southwestern states get the most sun and northeastern the least. But we need precise data. For this, you can use this super helpful peak sun hours chart.

State | Peak Sun Hours |

|---|---|

Alabama | 3.5 – 4 |

Alaska | 2 – 3 |

Arizona | 7 – 8 |

Arkansas | 3.5 – 4 |

California | 5 - 7.5 |

Colorado | 5 – 6.5 |

Connecticut | 3 |

Florida | 4 |

Georgia | 4 – 4.5 |

Idaho | 4 – 4.5 |

Illinois | 3 – 4 |

Indiana | 2.5 – 4 |

Iowa | 4 |

Kansas | 4 – 5.5 |

Kentucky | 3 – 4 |

Louisiana | 4 – 4.5 |

State | Peak Sun Hours |

|---|---|

Maine | 3 – 3.5 |

Maryland | 3 – 4 |

Massachusetts | 3 |

Michigan | 2.5 – 3.5 |

Minnesota | 4 |

Mississippi | 4 – 4.5 |

Missouri | 4 – 4.5 |

Montana | 4 – 5 |

Nebraska | 4.5 – 5 |

Nevada | 6 – 7.5 |

New Hampshire | 3 – 3.5 |

New Mexico | 6 – 7 |

New Jersey | 3.5 – 4 |

New York | 3 – 3.5 |

North Carolina | 4 – 4.5 |

North Dakota | 4 – 4.5 |

State | Peak Sun Hours |

|---|---|

Ohio | 2.5 – 3.5 |

Oklahoma | 4.5 – 5.5 |

Oregon | 3 – 5 |

Pennsylvania | 3 |

Rhode Island | 3.5 |

South Carolina | 4 – 4.5 |

South Dakota | 4.5 – 5 |

Tennessee | 4 |

Texas | 4.5 – 6 |

Utah | 6 – 7 |

Vermont | 3 – 3.5 |

Virginia | 3.5 – 4 |

Washington | 2.5 – 5 |

West Virginia | 3 |

Wisconsin | 3.5 |

Wyoming | 5.5 – 6 |

Multiply this number by 30 and you get an estimate of how many kilowatt-hours of electricity 1 kilowatt of solar panels will produce in your area in one month.

Example:

Let's consider that you live in California where the peak sun hours range from 5 to 7.5 hours. So, the average peak sun hours would be 6.25 hours. For the ease of calculation, we can round it to 6 hours. Now, if we multiple it by 30, we get 180 hours.

That means, in California, you'll get —

180 (monthly peak sunlight) hours = 180 kWh of electricity with 1 kW of solar panels

This is an important figure whether you’re looking to buy or lease solar panels.

Panel Wattage

The wattage or power rating tells you how much energy the panels will produce. Most panels installed today have a power rating of about 320 watts. Of course, you’ll need fewer panels with higher power ratings.

With this information, we can calculate how many panels your solar system needs:

Your monthly electricity usage (kWh) ÷ Monthly peak hours in your area (h) = The solar system size (kW)

Let's say, your monthly electricity usage is 877 kWh and the monthly peak sunlight hour is 180 in your location.

So, your solar system size would be —

877 kWh ÷ 180 h = 4.87 kW ~ 5kW

Let’s say you need a 5kW solar system.

Now it’s easy to tell how many solar panels you need. Multiply the solar system size by 1,000 to convert from kilowatts to watts, and divide it by the power rating of the panels you want to install.

Let’s say you live in California (6 hours peak sunlight), use 877 kWh a month, and want to install 320-watt panels.

So, the number of panels you'd need is —

(Solar system size × 1000) ÷ Power rating of the solar panels

= (5 kW × 1000) ÷ 320 W

= 5000 W ÷ 320 W

= 17.36 ~ 17

And there it is — you need 17 solar panels for your home!

Buying vs. Leasing Solar Panels: The Big Analysis

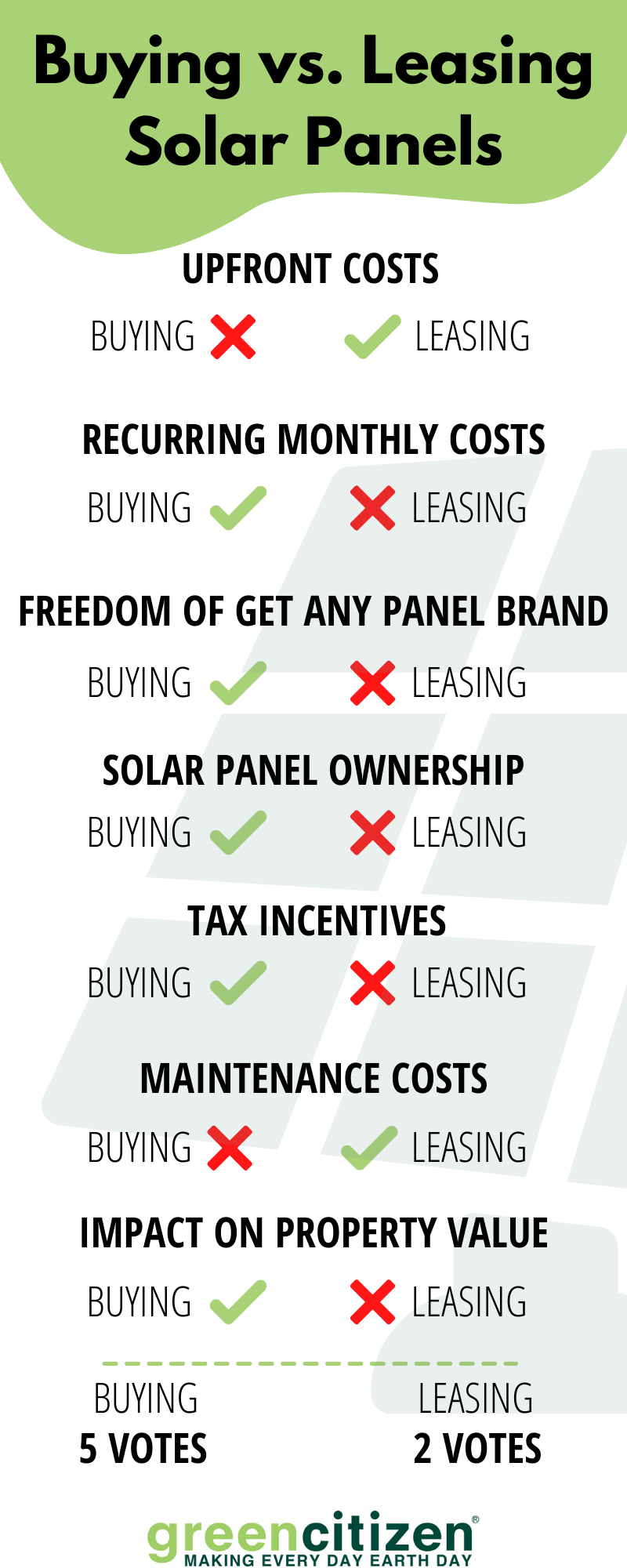

Upfront Costs

The price per watt for a solar panel system goes anywhere between $2.50 and $3.50 depending on your home’s geographic location. So the 5kW system from our example may cost at least $15,000.

This is big money, but if you’re looking to get a more accurate estimate you need to include the additional costs, as well. These include:

And the real problem is that you have to cash out more-less everything at once.

On the other hand, if you go with solar panel leasing, you can expect much lower upfront costs and in some cases even zero upfront. The solar leasing company takes care of all the installation, additional components, and permitting.

Winner: Leasing Solar Panels

Leasing clearly wins this round. Even with reduced state taxes through investment credits and government rebates that sometimes go up to 30%, you still have to face considerable upfront costs when you decide to buy your solar system.

Recurring Monthly Cost

It doesn’t come cheap, but when you buy a solar energy system in cash, you don’t have to worry about monthly costs.

And if you did your calculations right, you won’t have to worry much about your monthly electric bills, either.

Once you have them installed you can sit back and watch your savings fund grow. Even if you went through a solar or private loan, these payments will be fixed through the term of the loan.

On the other hand, these recurring monthly costs are a big downside to leasing solar panels.

But what’s so different between a solar loan and solar panel lease costs?

Solar leases usually include a price escalator, which specifies the amount in which the monthly lease payments will increase every year.

Whoa! Does this mean I’ll have to pay more in the third year than I did in the first year?

Definitely.

These increases are determined by predicting how much the price of electricity is going to rise in the future.

Winner: Buying Solar Panels

When it comes to recurring monthly costs, you’re better off purchasing. Sunlight is still free.

The Freedom to Choose Any Solar Panel Brand

Leasing can look attractive compared to buying. You don’t have to shop around for the best deals on panels, equipment, and installers’ quotes.

As Ron Swanson from Parks and Recreation would say, “You take me nowhere, and I talk to no one.”

However, you lose control of what happens on your roof. And I’m not talking only about the number and position of panels.

If you sign a lease, you don’t have much say in what type and brand of solar panels the company is going to install.

When you decide to buy, whether for cash or through a loan, you can for example choose the excellent LG solar panels, known for their durability and high efficiency of nearly 22%.

Solar panels by SunPower are also an option worth considering if you’re buying. They offer a decent warranty and come with the highest efficiency of all brands and still a reasonable price.

Winner: Buying Solar Panels

Leasing companies are always looking to maximize their profit and whichever brands they use, they’re looking for the quick ROI to be for their benefit, not necessarily yours. If you want the best stuff, you’ll have to buy it.

Who Owns the Solar System on Your Roof?

As I mentioned previously, in a solar panel lease agreement you literally lose control of your roof.

The leasing company may decide to put more panels than you want, and even put them in places that are facing the street, which can damage your home’s curb appeal.

When you are the one and only owner of the solar system on your roof, you can work out every detail with the installers so that you get it the way you want.

And there’s another issue with leasing — the fact that you do not own the panels.

So if you decide to move or sell the house, you’ll have to negotiate to purchase the lease or transfer the contract to the new owner.

Good luck with that.

It can be painstakingly hard to find a potential homeowner who’s just about to splurge on a new home and also be eager to enter a 20-year solar lease contract.

Even if they want to, the solar company may deny them from entering the contract if their credit score is too low.

Winner: Buying Solar Panels

When you buy solar panels, you can have them arranged how you want them where you want them. More importantly, you can take them with you when you move or sell them with the house for a nice bonus.

Who Reaps the Tax Incentives?

This is probably what talked me out of the leasing path. A big disadvantage of solar leases is that you don’t get to take advantage of solar rebates and the Federal Investment Tax Credit (ITC).

Even though the panels are on your roof, they are the property of the solar company, which reaps all the benefits instead of you.

OK, so if I’m buying, what should I know about the ITC?

The Solar Investment Tax Credit is a federal policy mechanism to support the growth of solar energy in the U.S.

Currently, it’s a 26% deferral tax credit claimed against the tax liability of residential investors in solar energy property (that is, you).

If granted, you can apply the credit to your income taxes.

However, under Section 48 it says that the business that installs, develops, and finances the project claims the credit (that is, a solar company).

The good news is that if you buy a newly built home with a solar system installed, and you are the owner, you are automatically eligible for the ITC the year you move into the house.

Winner: Buying Solar Panels

There’s no use sugarcoating it — if you lease, you give up all the state and government solar rebates and tax incentives to the solar company. If you don’t have the cash, get a loan.

Maintenance Costs

The typical rate for the most popular solar repairs is around $100 per hour, with an annual maintenance cost of about $18 per panel. Some of the most common problems include:

Solar panels need very little maintenance, apart from occasional cleaning, and problems like these are rare.

However, unless you are leasing them, all the maintenance costs come out of your pocket.

Winner: Leasing Solar Panels

Your solar lease company will take care of all the repairs and maintenance procedures free of charge. It’s all in the price. Just make sure the repairs are covered by the contract.

Impact on Property Value

Adding solar panels to your home saves energy and helps the environment. But did you know that it can also increase a home’s value?

According to Zillow Economic Research, homes with solar power systems sold for 4.1 more on average than similar homes without solar power.

It seems homebuyers are ready to spend more on solar homes because they can provide significant energy cost savings.

Yes, this means only if they get to purchase the solar system as well.

With solar leases, all bets are off.

Another research showed that solar leases can even scare off prospective homebuyers. For many of them, the buyout price in the contract was too high to pay on top of the new house.

To make it worse, transferring a lease on new owners is a complicated procedure that requires approvals from the utility, local landmarks commission, or the homeowner’s association.

Even in that case, the new homeowner may not meet the credit requirements.

It’s no rare case that the manufacturer of your leased panels places a lien on your property, making it almost impossible to sell your home until you’ve repaid the debt.

Winner: Buying Solar Panels

When it comes to increasing your property value, leased solar panels don’t have a single benefit. On the other hand, with a solar system that belongs to you, your property gets even more attractive to prospective buyers.

The Long-Term Cost Analysis: How Buying Is The Better Option?

Solar panels are a long-term investment, which means that you shouldn’t only be concerned with upfront costs.

Of course, a solar system is an investment if you are the owner. Otherwise, the long-term benefits go to the solar leasing company.

So why is buying a better option in long-term?

For one, with leased solar, your savings are never as high as when you own the system. You're constantly dragged back with the monthly payments, and there is also the notorious escalator clause that can increase payments by 3 percent per year.

So if you're paying $150 per month in year one, you’ll be paying $192 in year 10!

Ironically, if the real cost of energy doesn't rise at the same rate as the contracted lease payments, your savings can even dwindle.

On the other hand, a purchased solar power system pays itself in 5 or 6 years. After that, everything the panels produce is pure savings.

But what is the real ROI of solar panels?

We’ll use this formula:

Lifetime cost of electricity from utility − Lifetime cost of solar = Solar ROI

Here we need to consider the:

Let’s use the known figures from the example above — you’re installing a 5kW system which costs around $15,000.

Fees and permits vary by location, but shouldn't be more than $1,000.

And now kicks in the Federal Solar Tax Credit of 26% which applies to the cost of equipment, permitting, and installation costs.

Hurry up, the program shuts down for residential solar in 2024!

Your local utility will charge a monthly fee for the right to connect to the grid, which is about $15/month, or $4,500 over 25 years.

The system uses an inverter with a 12-year warranty that costs around $1,600 to replace. So if you have to replace it twice, that’s another $3,200 to the cost of the system.

All this considering the lifetime cost of owning this system is $19,540.

Now let’s see how much would it cost to keep buying electricity from the utility over 25 years:

Cost of electricity per kWh × Monthly kWh usage × 12 months × 25 years

= $0.1440 × 877 kWh × 12 months × 25 years

= $37,886.40

Now the only thing we need to do is compare these figures:

ROI of your solar system:

$37,886.4 − $19,540 = $18,346.4 in savings over 25 years.

Case closed!

Final Thoughts

After much consideration and weighing whether leasing solar panels has advantages over buying, I can definitely say that buying is a much better option.

As a buyer, I can choose from a range of quality products, and I’m not talking only about panels, but also the inverter and the mount.

With leasing, you’re stuck with what the solar company has to offer at the moment. More importantly, there are no increasing monthly payments, so I expect more savings in the long run, especially since I’ll apply for the Solar Tax Credit.

Finally, if I ever decide to move or sell my home, I can either take the panels with me or use them to make my offer more attractive.

What do you think? Are there any cases where a leased solar system actually makes more sense? If you have any questions or want to know more about solar panels feel free to ask.

Pingback: Patriot Power Generator Review: Is It A Scam? (2021 Updated) | GreenCitizen